Asia-Pacific markets set to climb on U.S.-India trade deal optimism; gold and silver rebound

Bombay Gate Gateway of India, Mumbai

Arutthaphon Poolsawasd | Moment | Getty Images

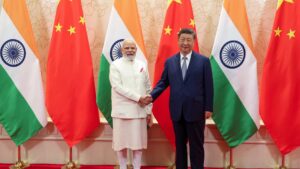

Asia-Pacific markets looked set to rise Tuesday after U.S. President Donald Trump said Washington and India had struck a trade deal and would immediately begin cutting tariffs on each other’s goods.

Trump added that Indian Prime Minister Narendra Modi had agreed to step up purchases of U.S. products, according to a Truth Social post on Monday following a call between the two leaders.

Under the deal, India will also stop its purchases of Russian crude oil and instead buy more from the U.S., and potentially, Venezuela, Trump added.

Japan’s Nikkei 225 futures pointed to a stronger open, with the contract in Chicago at 54,085 and its counterpart in Osaka at 54,000 compared to the previous close of 52,655.18.

Hong Kong Hang Seng index futures were at 26,953 above the benchmark’s last close of 26,775.57.

Australia’s S&P/ASX 200 jumped 1.3% in early trade. Australia’s central bank is set to raise its policy rate, economists polled by Reuters expect.

Investors will continue monitoring gold and silver prices following recent volatility which saw silver prices plunge around 30% last Friday, marking the metal’s worst one-day performance since 1980. Gold also dropped almost 10%.

Spot gold last gained about 2.22% to $4,769.33 per ounce, while silver added about 3.81% to $82.39 per ounce.

Overnight in the U.S., equities rose as Wall Street began a new month of trading, with investors looking past the recent losses in silver and bitcoin.

The Dow Jones Industrial Average advanced 1.05%, closing at 49,407.66, while the S&P 500 was up 0.54% and settled at 6,976.44. The Nasdaq Composite also gained 0.56% and ended at 23,592.11.

—CNBC’s Sean Conlon and Fred Imbert contributed to this report.