Nearly eight months into Ukraine war, EU still biggest buyer of Russian crude – Times of India

One of the direct impacts of this war has been on global crude oil prices, which surged to record highs in the few months following Russia’s invasion of Ukraine. In April, a barrel of Brent crude rose to as high as $139 amid supply disruptions and sanctions imposed by the United States and its allies.

The war has had a far-reaching impact on the global energy system, disrupting supply and demand patterns and fracturing long-standing trading relationships. It has pushed up energy prices for many consumers and businesses around the world, hurting households, industries and entire economies of several nations.

Apart from being the world’s biggest natural gas exporter, Russia is the second largest oil exporter after Saudi Arabia and a member of the Opec+ producer group that last week decided to cut output.

On Wednesday, Putin said that Russia planned to hold oil production and exports at current levels until 2025 and that Moscow would not cede its leading position in the global energy market despite Western sanctions.

Who buys, who doesn’t

While certain countries have stopped oil and gas purchase from Russia, there are still many who continue to do so.

However, despite a fall in the quantity of Russian crude oil purchased, the European Union (EU) still continues to be its biggest buyer.

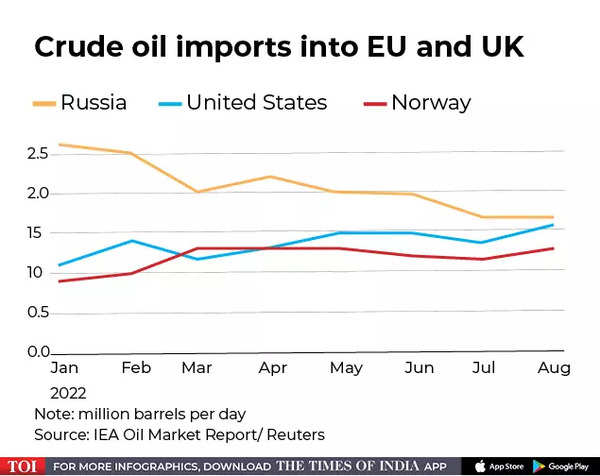

Russian oil imports into the European Union and United Kingdom fell 35% to 1.7 million barrels per day (bpd) in August from 2.6 million bpd in January. But according to International Energy Agency (IEA), EU is the biggest purchaser of Russian crude oil.

This comes even as the EU has said that it will ban importing Russian oil from December 5 this year. It plans to ban seaborne imports of Russian oil with a phase-in period of six months for crude oil and eight months for refined products. The ban will most likely create a shortage of oil due to a general lack of spare crude volumes in the world. This would in total cover about 90% of Russian oil imports to the EU.

Meanwhile, Australia, Britain, Canada and the United States have imposed outright bans on Russian oil purchases, while Group of Seven (G7) nations, including Japan, committed to ban or phase out imports of Russian oil on May 8.

Even before the adoption of the ban, at least 26 major European refiners and trading companies have voluntarily suspended spot purchases or announced plans to phase out a combined 2.1 million barrels per day (bpd) of Russian imports, according to JP Morgan.

US to replace Russia?

According to a report by Reuters, so far imports from the US have replaced about half the 800,000 barrels of lost Russian imports, with Norway providing around a third.

The United States could soon overtake Russia as the main crude supplier to the EU and the UK combined – by August, US imports lagged those from Russia by just 40,000 bpd compared with a 1.3 million bpd pre-war average, according to the IEA.

Outside the EU, Russia’s top crude oil export markets are China, India and Turkey.

Benefit for India, China

China and India are benefiting from discounts on Russian crude.

India’s crude oil imports from Russia have jumped over 50 times since April and now it makes up for 10% of all crude bought from overseas. Russian oil made up for just 0.2% of all oil imported by India prior to the Ukraine war.

According to reports, India is estimated to have gained Rs 35,000 crore by importing Russian crude at a discount.

The country has emerged as the second-largest buyer of Russian crude after China. Russian oil accounts for 12% of the country’s total oil purchase against less than 1% before the war. In July, Russia became India’s second-largest oil supplier, relegating Saudi Arabia to the third spot.

Meanwhile, China is buying more and less expensive energy supplies from Russia this year, reaping the benefits of a plunge in European purchases.

China has gained access to cheaper energy while Russia is able to offset losses from the European Union and other allies scaling back on purchases of Russian exports due to sanctions over its invasion of Ukraine. Moscow calls it a special military operation.

China, the world’s largest energy consumer and top buyer of crude oil, liquefied natural gas and coal, has imported 17% more Russian crude between April and July from the same period a year ago.

What are the alternatives for EU

Under the looming ban, the EU will need to replace an additional 1.4 million barrels of Russian crude, with some 300,000 bpd potentially coming from the United States and 400,000 bpd from Kazakhstan, the IEA has said.

Norway’s largest oilfield Johan Sverdrup, which produces medium-heavy crude similar to Russia’s Urals, also plans to ramp-up production in the fourth-quarter, potentially by 220,000 bpd.

The IEA says imports from other areas such as the Middle East and Latin America would be needed to fully meet EU demand.

Some Russian oil will continue to flow into the EU via pipelines as the ban excludes some landlocked refineries unless Russia decides to stop the flows.

How much is EU dependent on Russia

Germany, the Netherlands and Poland were the top importers of Russian oil in Europe last year, but all three have capacity to bring in seaborne crude.

Landlocked countries in Eastern Europe, such as Slovakia or Hungary, however, have few alternatives to pipeline supplies from Russia.

The EU’s dependence on Russia has also been underpinned by companies such as Rosneft and Lukoil, controlling some of the bloc’s largest refineries.

Russian crude oil flows, based on loading data in August, rose month-on-month to Italy and the Netherlands, where Russian oil major Lukoil owns refineries, according to the IEA.

The German government on September 16 took control of the Rosneft-owned Schwedt refinery which supplies about 90% of Berlin’s fuel needs.

Also in September, the Italian government said it hoped Lukoil would find a buyer for its ISAB refinery in Sicily, which accounts for a fifth of the country’s refining capacity.

(With inputs from Reuters)