Trucks move into fast lane in May as curbs ease

[ad_1]

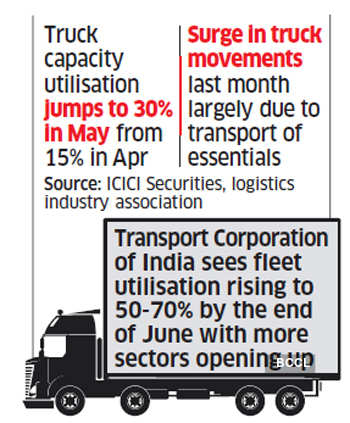

Capacity utilisation was 30-35% in May with transport of essential goods — including medicines and specific food items — at pre-Covid levels, according to several industry associations and fleet operators. However, fleet operators say that unless economic momentum gathers pace, many transporters may be forced to fold up in the next few months.

Transport Corporation of India (TCI), India’s largest logistics provider, sees fleet utilisation rising to 50-70% by the end of June with more sectors opening up. Demand for essentials is being fully met and the supply chains for the segment have worked smoothly during the lockdown, said Jasjit Sethi, CEO, TCI Supply Chain Solutions.

‘Next 2 Months Critical’

Sethi said that all the components of GDP have started moving.

“May has been a crucial month of the restart with the ‘new normal’. The flows are still not perfect with backhauls a concern, port congestion in evacuation, but they are improving,” Sethi said. “We see the last week of June coming to a 70% level in run rate.”

TCI uses 12,000 trucks to move goods; it owns 2,000 of them. It has six ships that operate along the west and east coasts.

The company has a joint venture with Concor to transport freight by rail and 12 million square ft of warehousing space.

With industries restarting and the kharif harvest underway, capacity utilisation is set to rise. For instance, the passenger car and two-wheeler segment is planning to increase output to 25-30% of capacity from 10-15%, calling for increased freight movement.

While sentiment has improved, the pickup in activity is gradual and essentials goods still dominate, said Bal Malkit Singh, chairman of the core committee at the All India Motor Transport Congress (AIMTC) lobby group.

“Strong agriculture output boosted truck utilisation,” he said. “Now there is significant overcapacity in the market, and the demand environment is quite tepid right now.” The next two months will be critical and will determine whether the jobs of truck drivers can be saved, he said.

Consultancy Deloitte pegs the Indian logistics market at $160 billion, of which road transport is a key element.

Transporters Go for

Truck utilisation was already down to 65% in January 2020, before the pandemic struck, due to the economic slump. With a recession looming, fleet demand is still poor, said SP Singh, senior fellow, Indian Foundation of Transport Research and Training (IFTRT).

More than 60% of transporters and fleet owners have opted for the extended moratorium on repayment of EMIs that ends in August. Most fleet owners may not be able to resume EMI repayments and mass repossessions could result, he said.

[ad_2]

Source link